A Very Special 11th INFINITI Conference

“The Financial Crisis, Integration and Contagion”

10-11 June 2013

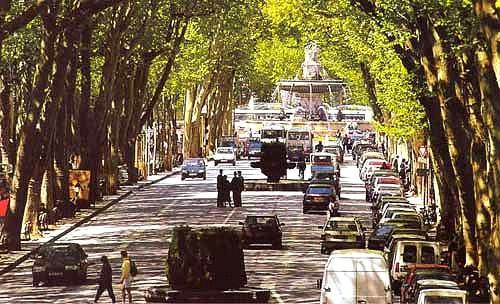

SciencesPo Aix, Aix-en-Provence, France

Organised by SciencesPo Aix, Trinity College Dublin and Euromed Management Marseille, in coordination with the Aix-Marseille School of Economics.

Best Paper Award:

Coping with Financial Crises: Latin American Answers to European Questions

*Eduardo Cavallo, Inter-American Development Bank, USA

Eduardo Fernández-Arias, Inter-American Development Bank, USA

Best Student Paper Award:

Assessing the contribution of banks, insurances and other financial services to systemic risk

*Grégory Guilmin, Université de Namur, Belgium

Oscar Bernal, Université de Namur, Belgium

Jean-Yves Gnabo, Université de Namur, Belgium

Keynote Speakers:

René M Stulz, The Ohio State University, USA

René M Stulz is the Everett D Reese Chair of Banking and Monetary Economics at the Ohio State University and the Director of the Dice Center for Research in Financial Economics at the Ohio State University. He previously taught at the University of Rochester and held visiting appointments at the Massachusetts Institute of Technology and the University of Chicago. He was a Marvin Bower Fellow at the Harvard Business School for the 1996-1997 academic year. He received his Ph.D. from the Massachusetts Institute of Technology. He holds an honorary doctorate from the University of Neuchâtel in Switzerland and is a Fellow of the Financial Management Association.

René is currently President of the American Finance Association and President of the Western Finance Association. Currently a trustee of the Global Association of Risk Professionals, he is also responsible for the Financial Risk Manager certification examination of that association. He was editor of the Journal of Finance for twelve years and a co-editor of the Journal of Financial Economics for five years. He is on the editorial board of several academic and practitioner journals. Further, he is a research associate of the National Bureau of Economic Research.

He has published more than sixty papers in finance and economics journals, including the American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics, the Journal of Financial Economics, the Journal of Finance, and the Review of Financial Studies. His research addresses issues in corporate finance, banking, international finance, risk management, and investments. René M. Stulz is the author of the textbook “Risk Management and Derivatives.” He is conducting research on the relation between shareholder wealth and firm-wide risk, the impact of risk management on firm value, mergers, firm valuation, banking crises, emerging market crises, contagion, liquidity, and international equity flows.

René teaches in executive development programs in the US and in Europe. He has consulted for major corporations, the New York Stock Exchange, and the World Bank. As a litigation consultant and expert witness, he has been involved in valuation, corporate finance, banking, derivatives, compensation, securities fraud, and international finance cases. He is a director of Weggelin Fund Management, a director of Community First Financial Group, Inc., and the president of the Gamma Foundation.

Geert Bekaert, Columbia University, USA

Geert Bekaert is the Leon G Cooperman Professor of Finance and Economics at Columbia Business School and a Research Associate at the National Bureau of Economic Research (NBER). Before joining Columbia, Geert was a tenured Associate Professor of Finance at the Graduate School of Business, Stanford University. He received his PhD in 1992 from Northwestern University’s Economics Department. His thesis won the 1994 Zellner Thesis Award in Business and Economic Statistics.

Geert has published over 50 articles in the Journal of Finance, the Journal of Financial Economics, the Review of Financial Studies and other academic journals. He is Co-editor for the Review of Financial Studies.

Geert’s research focus is international finance with a particular interest in foreign exchange market efficiency, global market integration and international equity markets. Geert has also been involved in several projects on emerging equity markets, on investment and asset allocation problems and empirical asset pricing more generally. Geert ‘s research has been supported by three NSF grants so far.

In addition, Geert consults for the European Central Bank in Frankfurt and is also a financial economist for Financial Engines, a public company, founded by William F Sharpe, the 1990 Nobel Prize Winner in economics. Financial Engines provides state-of-the-art, quantitative investment advice to individual investors.

Geert has taught classes on International Financial Markets, Global Fixed Income, Global Asset Allocation, Empirical Asset Pricing (for PhDs), Capital Markets and Investments and Investment and Wealth Management. With Bob Hodrick, he is the author of a textbook on International Financial Management.